Turning Active Property Management

into Passive Income

What is The 721 Exchange?

Overview

The 721 Exchange, named after Section 721 of the U.S. Internal Revenue Code, allows real estate owners to contribute their property into a partnership or real estate investment trust (REIT) in exchange for ownership shares. This is structured as a tax-deferred exchange, meaning capital gains taxes are not immediately due upon contribution. This strategy has been widely used by institutional investors and high-net-worth individuals seeking long-term capital preservation. Now, through structured partnerships, the 721 Exchange is accessible to a broader range of real estate investors.

Key Benefits of the 721 Exchange

How it works for you

Capital Gain and Claimed Depreciation Tax Deferral

Taxes on appreciation and claimed depreciation can be deferred indefinitely, allowing investments to continue compounding.

Diversification

Instead of being tied to the performance of a single property, investors gain access to a professionally managed portfolio.

Liquidity Flexibility

Investors can gradually liquidate their shares over time, reducing the impact of taxable events.

Elimination of Active Management

No more dealing with tenants, maintenance, or lease negotiations. A professional team handles all operations. Just sit back and enjoy your returns.

The Provision Capital Fund

Executive Summary

Investor Experience

Made for transparency

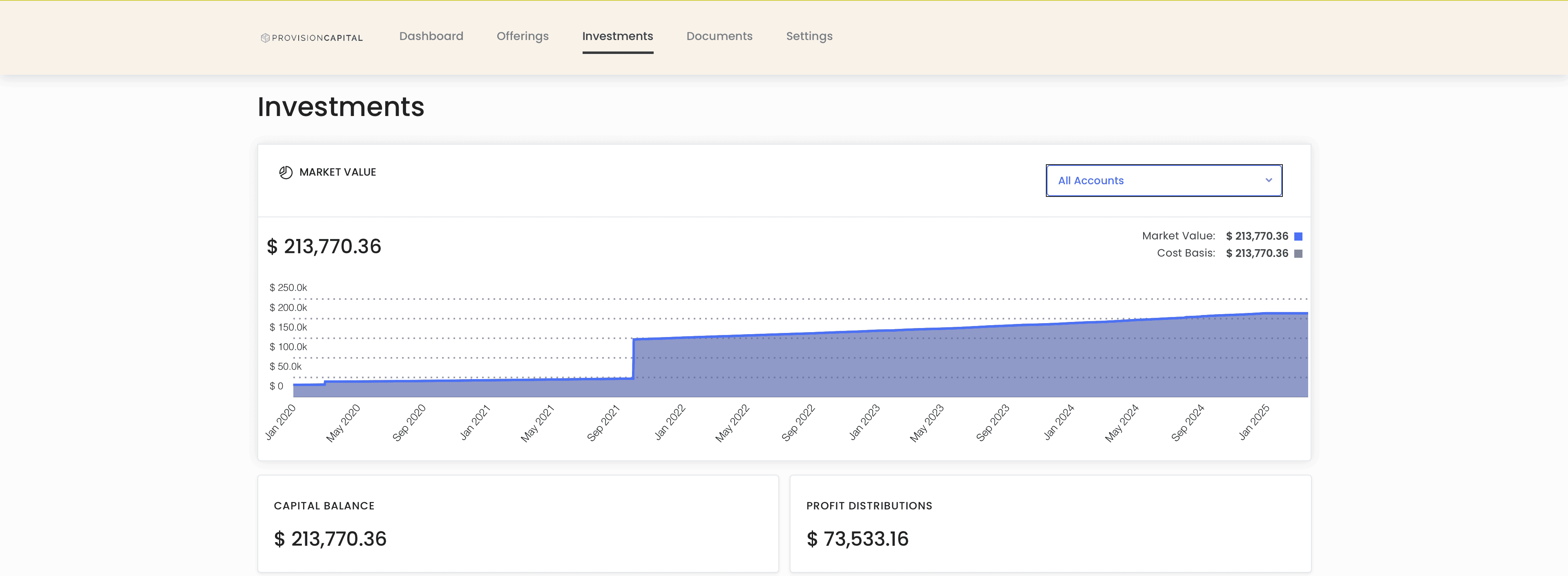

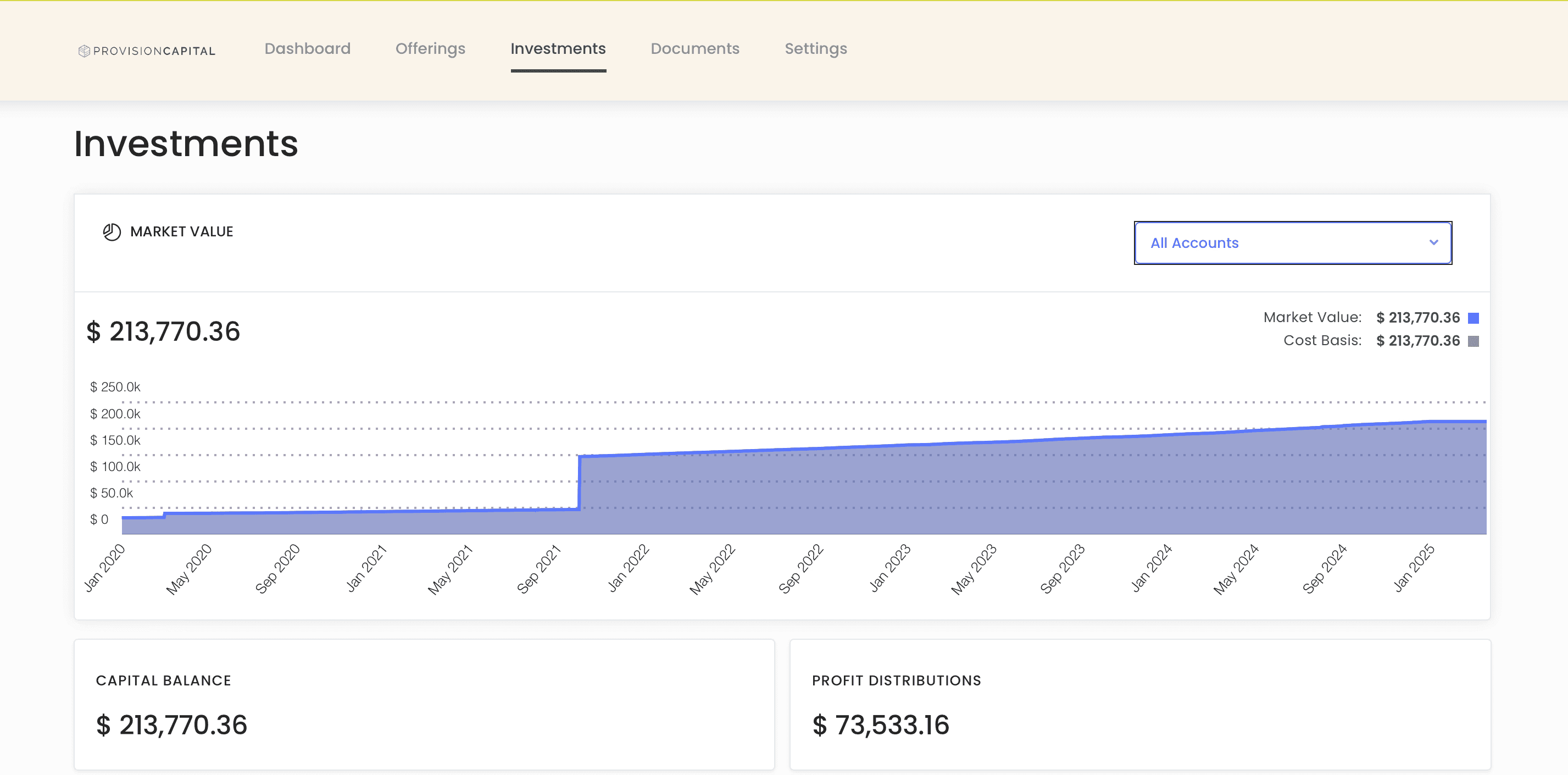

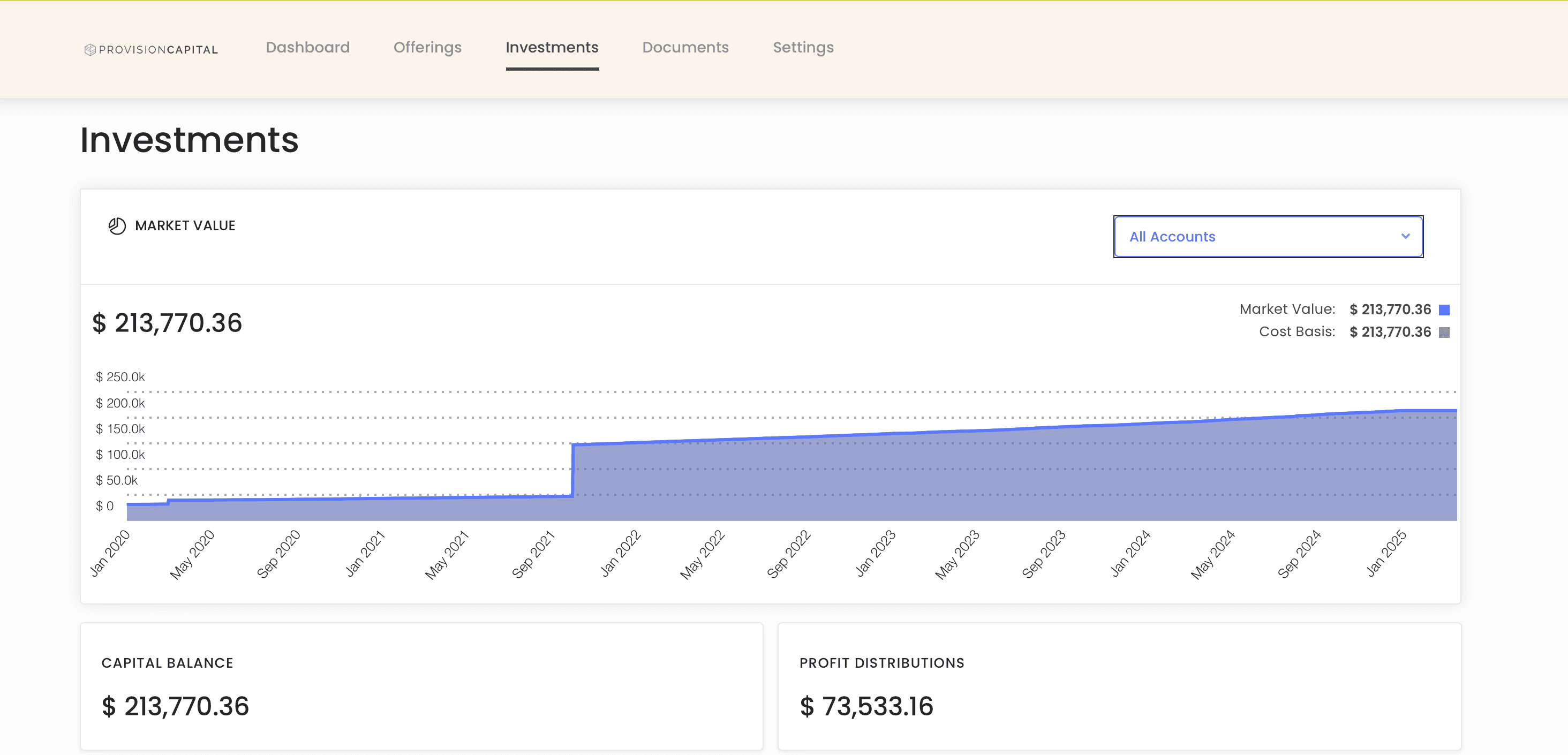

Investor Portal

Easily track your investments anytime and anywhere. The investor portal puts everything at your fingertips, including performance updates, documents, and distributions. It’s designed to give you peace of mind and a sense of control without the hassle.

Fees

When you sell your home, a one-time, 6% fee is deducted from your account. There are no out-of-pocket costs. This fee covers all transaction, onboarding, and admin costs, ensuring a smooth, transparent transition with no hidden charges.

Accessing your Returns

The fund is built for both stability and flexibility. Your initial investment is held for one year, but you’ll still receive accessible quarterly distributions. After that, you can liquidate shares anytime per fund policies, offering liquidity without the hassle of selling property.

Mouyyad's Story

Client Testimonial

Mouyyad Abdulhadi

Real Estate Investor and Co-Founder of Pax & Beneficia

How to Get Started

Your journey begins here

Step 1: Discovery Call

Schedule a quick call to learn more about the process, ask questions, and see if your property is a fit for the fund.

Step 2: Evaluation & Offer

We’ll conduct due diligence and provide a formal offer based on your property’s value and alignment with fund criteria.

Step 3: Sign Agreements

Once you accept the offer, you’ll sign the necessary agreements to transfer your property into the fund in exchange for an ownership interest.

Step 4: Onboarding & Ownership

After the transaction, you’ll be onboarded and gain access to your investor portal to track performance and enjoy passive, tax-efficient ownership. Congratulations!

Leadership

Our Team

Abdullah Ahmad

Chief Executive Officer

Abdullah is the CEO of Provision Capital and RentReady Homes, LLC, the fund’s general partner. Since 2011, he has closed over $250 million in real estate across Texas, including 700+ homes. A former accountant with KPMG and PwC, he holds a B.B.A. in Accounting from Hofstra University and brings a strategic mix of financial and real estate expertise.

Mahmood Usmani

Chief Operating Officer

Mahmood is the COO of Provision Capital, overseeing operations and strategic growth. He joined in 2016 with a background in management and corporate strategy, previously working at Huron Consulting Group. He holds a B.S. in Economics and Corporate Strategy from Vanderbilt University and brings strong analytical and operational expertise to the team.

Alasha Reed

Senior Analyst & Underwriter

Alasha leads underwriting and investment analysis at Provision Capital, conducting detailed evaluations to support fund performance and investor confidence. She has helped manage over $10 million in investor contributions, ensuring accurate reporting and clear communication throughout the process. She holds a degree in Finance from the University of Alabama at Birmingham.

Haitham Aqel

Transaction Coordinator

Jordan Crowe-Ware

Property Manager

Danie Young

Property Manager

Nahid Arif

Onboarding & Client Experience

Questions & Answers

Learn more about what Provision has to offer or feel free to contact us at 721@provisioncapital.com

Contribute Your Property Today!

Schedule a quick call with our team to learn more about the process, ask questions, and see if your property is a fit for the fund.